Smarter Trades, Clearer Insights:

How core64 Transformed One of Europe’s Largest Energy Trading Platforms

We developed an interpretable ML-based recommender system for trading within the energy sector, focusing on enhancing user experience through transparent classification models.

[CLIENT]

Enmacc is Europe’s largest over-the-counter trading market venue for energy and environmental commodities. The digital market venue includes power, gas, Guarantees of Origin, Renewable Energy Guarantees of Origin, emissions allowances and weather derivatives, enabling members to trade faster, more widely, and with greater control. enmacc is trusted by over 2000 traders from over 600 member companies, including large utilities, industrials, energy majors, trading houses, financial institutions, and municipal suppliers.

[CHALLENGE]

Predicting the likelihood of a trade following an RFQ (Request for Quote) posed a significant challenge, demanding a solution with exceptional accuracy. This can be used to support traders in real-time, data-driven insights to navigate a fast-paced and volatile energy market effectively.

Additionally, the user experience for traders always needs to overcome the hurdles of complexity and heterogeneity of market data, to avoid a high cognitive load for users. Existing solutions addressed these issues only partially, leaving room for improvement in usability and data presentation. A comprehensive approach to solving these challenges promised not only enhanced user satisfaction but also the potential to drive greater trading activity on the platform.

[SOLUTION]

Initial Baseline (i.e., solution in production at the project’s start)

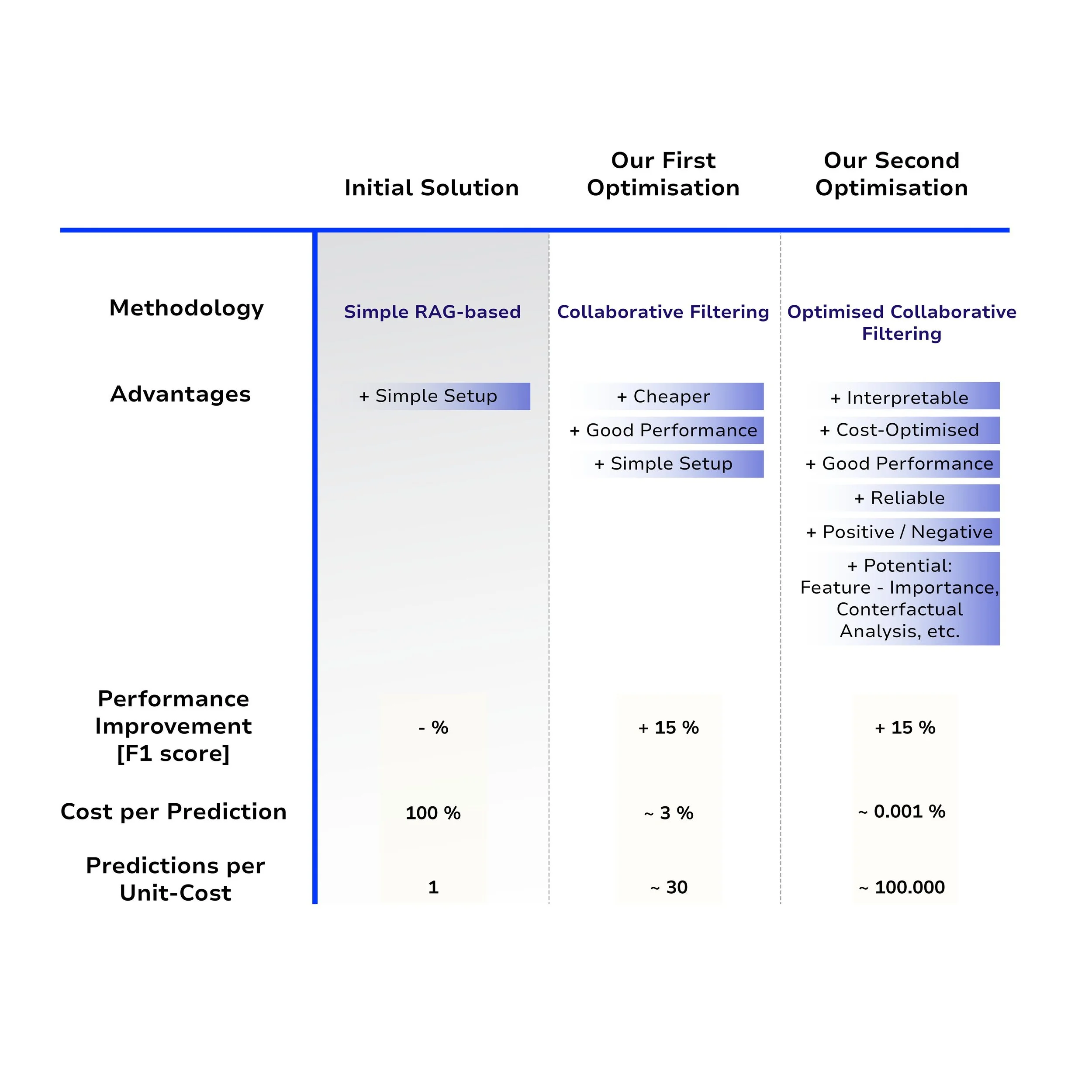

The initial proof-of-concept focused on identifying patterns in past trading requests to predict whether a trade would occur. While straightforward and effective for a quick start, it depended on external services, incurred high costs, and provided limited insights into the decision-making process.

First Optimisation by core64

Core64 built on the initial setup by introducing a more cost-efficient process that minimized reliance on external systems. This improvement boosted prediction performance and reduced operational costs while maintaining the simplicity of the original solution. However, the challenge of providing clearer explanations for the predictions persisted.

Second Optimisation by core64

In the next iteration, Core64 introduced a more sophisticated approach to analyze trading data. This new solution delivered highly accurate predictions, offered greater transparency by highlighting the factors influencing decisions, and significantly reduced costs. It also laid the groundwork for future developments, such as deeper insights into key drivers of trading outcomes.

[OUTCOME]

We improved the client’s recommender system by reducing costs, increasing prediction accuracy, and providing clearer insights into decision-making. These enhancements streamlined operations, will improve user experience, and support increased trading activity.

::

Ready to unlock smarter, more transparent solutions for your platform?

Get in touch with us today to explore how we can help you build interpretable, high-impact systems tailored to your business needs.